Important tax information

ESPACE GOLD CHANGE

INFORMING YOU

Taxation of precious metals

The sale of gold, silver, jewellery, watches or collectors' items is subject to specific taxation under the General Tax Code (articles 150 VI to 150 VM).

There are two schemes depending on the seller's situation:

TMP: TAX ON PRECIOUS METALS

Principle

TMP is a flat-rate tax levied on the total sale price, regardless of the profit made. It applies automatically, unless the seller chooses to opt for the real capital gains regime.

Current rates

- 11 % for precious metals (gold, silver, platinum, ingots, coins, etc.).

- 6 % for jewellery, works of art, collectors' items and antiques.

Plus CRDS of 0.5%.

Who pays this tax?

The tax is deducted at the time of sale and paid directly by Espace Gold Change with the tax authorities, guaranteeing you a simple, straightforward transaction with no additional formalities.

TPV: TAX ON REAL CAPITAL GAINS

Principle

TPV is an alternative to TMP. It only applies if the seller can prove the price and date of acquisition of the property (invoice, inheritance deed, certificate of purchase, etc.). In this case, tax is not levied on the total sale price, but only on the profit actually made:

Capital gain = Sale price - Purchase price

VAT rate

- 19 % income tax

- 17.2 % social security contributions

That is 36.2 % on the net capital gain, after an allowance based on the length of time held.

Progressive allowance

The law provides for a gradual reduction depending on the length of the holding period:

- Less than 2 years: 0% allowance

- 3 to 22 years: 5 % per year of detention

- Over the age of 22: 100 % exemption

Who pays this tax?

The tax is declared and paid by the seller in the month following the sale, using official form 2092, with the option of assistance from Espace Gold Change to simplify the process.

TAX ON GIFTS

When a precious asset, such as a gold coin, is transferred without consideration, it is subject to the free transfer duties defined in articles 790 E and 790 F of the French General Tax Code.

These transfers may, however, benefit from allowances or exemptions depending on the family relationship.

- Children and disabled beneficiaries (subject to conditions): €100,000

- Between spouses or PACS partners: €80,724

- Siblings: €15,932

- Grandchildren: €31,865

- Nephews and nieces: €7,967

- Great-grandchildren: €5,310

There is no allowance for unmarried cohabitees or unrelated persons. A flat-rate tax of 60 % applies to the total value of the assets.

Feed-in tariff for jewellery not intended for melting and other goods

In accordance with Article 4 of the Order of 18 August 2015

1. ASSESSMENT PROCEDURE

The assessment is carried out by a mandated buyer-appraiser by the company ESPACE GOLD CHANGE, In accordance with the regulations governing consumer information on the purchase prices of precious metals.

If necessary, the company can call on external experts to refine the estimate. This is always carried out before offering the consumer-seller an overall purchase price, presented in the contract in the form of a firm and definitive offer.

2. ASSESSMENT CRITERIA

The items offered for purchase are subject to a personalised expertise carried out by the company, taking into account a number of parameters, in particular :

- La brand, the model and the rarity of the object ;

- Sound status general, and any restorations or repairs required; ;

- L’seniority and the type of materials (precious metals, fine or precious stones, engravings, etc.) ;

- La presence of additional elements such as the original box, invoice, service book or authenticity card; ;

- La resale value on the second-hand market, Some models are benefiting from increased demand, which is having an impact on the buyback offer.

3. AUTHENTICITY AND RESERVATION

If there is any doubt about the authenticity, provenance or quality of an item, the company reserves the right to refuse the immediate purchase and to offer an alternative. contract of deposit.

4. CONTRACT OF DEPOSIT

In this context :

- The object is temporarily entrusted to the company for a thorough examination on its premises; ;

- At the end of the appraisal, a buyback proposal is sent to the depositor; ;

- In the event of refusal, the item will be returned in the condition in which it was handed over, at the company's expense.

5. LIMITATION OF LIABILITY

The company is bound only by an obligation of best endeavours in connection with the valuation. It cannot be held responsible in the event of a subsequent dispute concerning the estimated value or the fluctuation of second-hand market prices.

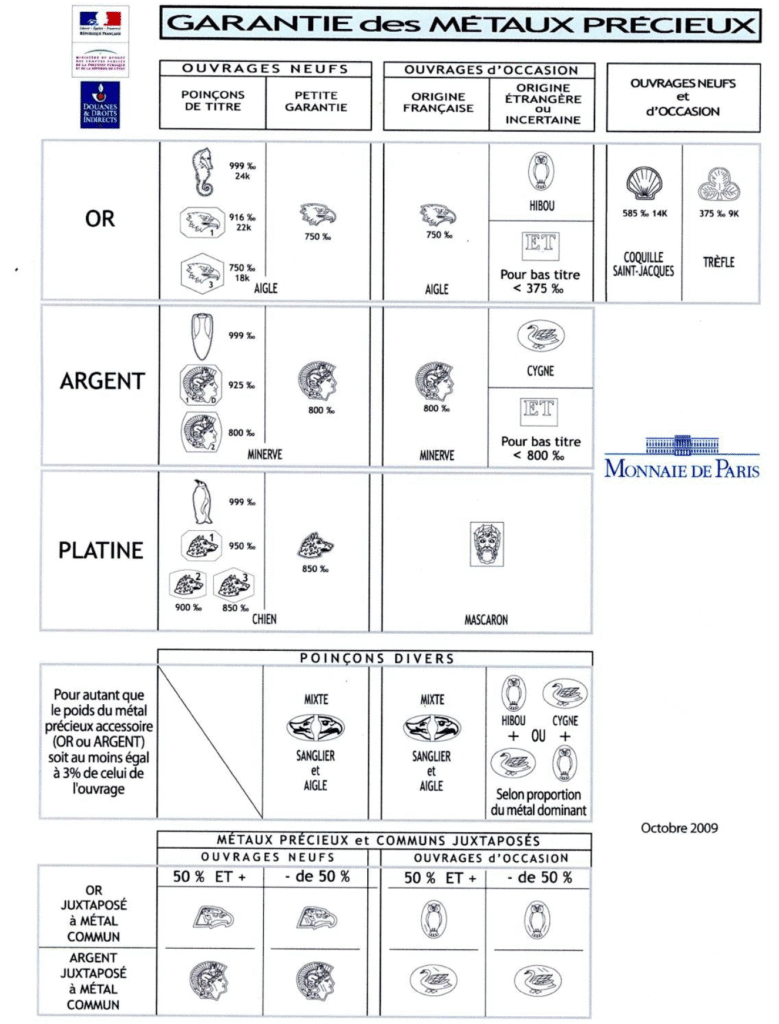

Punches

Tax on precious metals, jewellery, works of art, collectors' items and antiques

THE TAX ON PRECIOUS METALS IS PAID IN FULL BY US IN ACCORDANCE WITH THE CONDITIONS SET OUT IN ARTICLES 150 VJ TO 150 VM

ARTICLE 150 VI

I. Subject to the provisions specific to business profits, the following are subject to a flat-rate tax under the conditions set out in items 150 VJ to 150 VM transfers for consideration or exports, other than temporary, outside the territory of the Member States of the European Union:

1° Precious metals ;

2° Jewellery, works of art, collectors' items or antiques.

II (Repealed)

Law no. 2013-1278 of 29 December 2013 on finance for 2014, art. 19 III: These provisions apply to transfers and exports of goods carried out from 1 January 2014.

ARTICLE 150 VJ

The following are exempt from tax :

1° Transfers made to a museum that has been awarded the »Musée de France» designation provided for in article L. 441-1 of the Heritage Code or a local authority museum; ;

2° Transfers made to the Bibliothèque nationale de France or to another State library, local authority or other public entity; ;

3° Transfers made to an archive service of the State, a local authority or another public body; ;

4° Transfers or exports of the goods mentioned in 2° of I of Article 150 VI where the sale price or customs value does not exceed €5,000; ;

5° Transfers or exports of goods mentioned in I of article 150 VI, where the transferor or exporter is not resident in France for tax purposes. The exporter must be able to provide proof of prior importation, introduction or acquisition in France; ;

6° Repealed.

Law no. 2013-1278 of 29 December 2013 on finance for 2014, art. 19 III: These provisions apply to transfers and exports of goods carried out from 1 January 2014.

ARTICLE 150 VK

I. The tax is borne by the seller or exporter. It is payable, under their responsibility, by the intermediary established for tax purposes in France involved in the transaction or, in the absence of an intermediary, by the purchaser where the latter

is a taxable person for value added tax established in France; in other cases, it is payable by the seller or exporter.

II. The tax is equal to :

1° A 11 % of the sale price or the customs value of the goods referred to in 1° of I of Article 150 VI ;

2° A 6 % of the sale price or of the customs value of the goods mentioned in 2° of the I of article 150 VI.

III. - The tax is payable at the time of transfer or export.

ARTICLE 150 VL

The seller or exporter may opt for the scheme defined in Article 150 UA provided that you can prove the date and price of acquisition of the property, or that the property has been owned for more than twenty-two years. In this case, the flat-rate tax provided for in Article 150 VI is not due.

Law no. 2013-1278 of 29 December 2013 on finance for 2014, art. 19 III: These provisions apply to transfers and exports of goods carried out from 1 January 2014.

ARTICLE 150 VM

I. A declaration, in accordance with a model drawn up by the authorities, shall show, as appropriate, the information used to calculate the tax or the option provided for in Article 150 VL. It is registered:

1° For sales carried out with the participation of an intermediary domiciled in France for tax purposes or, in the absence of an intermediary, where the purchaser is a taxable person for value added tax purposes established in France, by the intermediary or the purchaser, to the tax department responsible for collecting the tax on which the intermediary or purchaser depends or, in the case of a ministerial officer, to the tax department responsible for collecting the tax on which the deed is registered, where the deed must be submitted for registration, within the period stipulated in article 635.

However, when subject to value added tax, the intermediary, purchaser or registrar shall declare the tax:

a) On the annex to the declaration referred to in Article 1 287 filed in respect of the month or quarter during which the flat-rate tax became chargeable if it is liable for value added tax and subject to the normal actual taxation system; ;

b) On the annual return referred to in Article 287(3) filed in respect of the financial year during which the flat-rate tax became chargeable if it is liable for value added tax and is subject to the simplified taxation scheme provided for in Article 302 septies A ;

c) On the appendix to the declaration mentioned in Article 287(1) filed with the tax collection department responsible for the main establishment no later than the 25th day of the month following the month in which the flat-rate tax became chargeable if the taxable person is not liable for value added tax.

2° For exports or transfers to a third country of temporarily exported goods, by the exporter to the customs office responsible for the export, when completing customs formalities; ;

3° For other transfers, by the seller to the tax office responsible for collection within one month of the transfer.

II. The tax is paid when the declaration is filed.

III. The tax is collected :

1° For sales carried out with the participation of an intermediary or, in the absence of an intermediary, where the purchaser is a taxable person for value added tax purposes established in France, in accordance with the rules, guarantees and penalties laid down for turnover tax; ;

2° For exports and transfers to a third country of goods temporarily exported, in accordance with the provisions of the customs legislation in force; ;

3° For other transfers, in accordance with the rules, guarantees and penalties set out in Title IV of the Book of Tax Procedures for taxes collected by the competent public accountants.

IV. Complaints are submitted, investigated and judged in the same way as for turnover tax if the tax is collected by the accountants of the Directorate General of Public Finances and in the same way as for customs if the tax is collected by the customs receivers.

In accordance with II of Article 10 of Order no. 2015-681 of 18 June 2015, the provisions of Article 150 VM, as amended by this Order, apply to returns filed from 1 February 2016.